Business Sector Unhappy as Central Bank Maintains Status Quo on Policy Rate

Karachi: On Monday, the industrial sector openly criticized the central bank for maintaining its policy rate at an unwavering 22 percent. Industry leaders asserted that this decision is untenable for businesses, foreseeing closures and a halt in new investments.

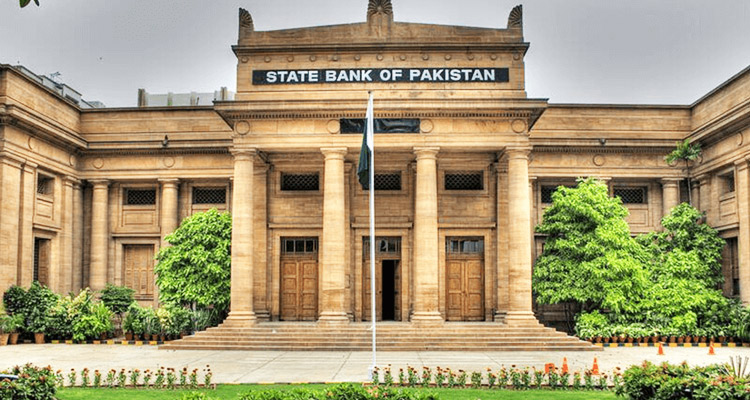

The State Bank of Pakistan (SBP) opted to sustain the policy rate, citing the impact of frequent and substantial adjustments in administered energy prices on inflation and inflation expectations.

Representatives from the Federation of Pakistan Chambers of Commerce & Industry (FPCCI) and All Pakistan Textile Mills Association (APTMA) expressed their disappointment over the policy rate remaining stagnant, expressing hopes for a cut that could have provided some relief to the struggling industry.

Saqib Fayyaz Magoon, acting president of FPCCI, voiced concerns, stating, "This policy rate is insufferable for the industry, potentially leading to the closure of more businesses." He highlighted that when industries were expanding with new investments, the policy rate was at 13 percent.

However, the scenario drastically changed as the policy rate soared to an all-time high of 22 percent. Magoon emphasized that the high interest rate significantly increased the industrial sector's costs, rendering it uncompetitive in the global market.

Magoon pointed out that the high-interest-rate environment had also discouraged investment in the industrial sector, already grappling with elevated energy and raw material costs due to the dollar's appreciation against the rupee. He advocated for an interest rate ranging from 10 percent to 12 percent to attract new investments for expansion and modernization.

Asif Inam, chairman of the All Pakistan Textile Mills Association (APTMA), shared his disappointment over the decision to maintain the policy rate, considering it excessively high for the industry's growth.

Inam revealed that APTMA had presented the new government with a roadmap to double the country's textile exports to $50 billion from $25 billion. However, he emphasized that this ambitious target could only be achieved by lowering the interest rate.

He asserted, "A single-digit policy rate could catalyze industry growth and contribute significantly to the country's economic prosperity."

Inam highlighted that Pakistan's interest rate was higher than that of the region, and a reduction could bolster exports, ultimately improving the country's balance of payments.